Take a look at this list of essentials. The third large office equipment or furniture should each be classified as a fixed asset to be depreciated over time.

Are Office Supplies Categorised As Assets Or Expenses Youtube

As a small business grows into a bigger office space its time to celebrate and to think about the office supplies furniture and other essentials you need to keep your business running as smoothly as possible.

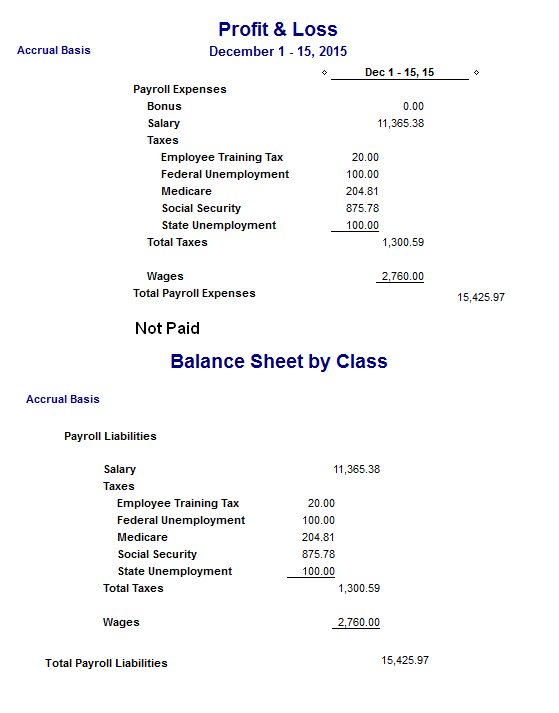

. In the case of office supplies if the supplies purchased are insignificant and dont need to be classified as a current asset you can simply debit the supplies as an expense to your Office Supplies account. At Office Depot customers can access these coupons in stores or online scoring great deals no matter how they prefer to shop. You can include office expenses less than 2500 in this category or you can separate office expenses out and include them with Other Expenses on Line 27a.

In the world of double-entry bookkeeping every financial transaction affects at least two accounts. We provide a comprehensive range of office supplies including Stationery Supplies Office Equipment and IT Products to companies in Singapore. Mega Thing Pty Ltd Previously Mega Office Supplies is the largest expert pure play online Australian supplier of business equipment stationery and office supplies products.

Shopping for school supplies online offers distinct benefits but browsing in person has advantages as well. Your office expenses can be separated into two groups - office supplies and office expenses. The Mega Thing purpose is to deliver the wow in office supplies from any device to any door.

Since refrigerators have a useful life that is more than a year you may include it under Furniture Fixtures and Equipments as long as it is categorized to a Fixed Asset account type. Office expenses are often. Most companies require office supplies to function with some companies needing more supplies than others to keep operations running smoothly.

Office expenses like office supplies are typically recorded as an expense rather than an asset. A dynamic company that has been in the business for almost 30 years. AC Adapter 3 Academic Planner 22 Accessory Hook 1 Accessory Tray 2.

Office Supplies and Expenses on Your Business Tax Return. The Average Cost Per Month for Office Supplies. Ring Binder 516 Dry Erase Board 455 Printed Book 429 Gel Pen 363 Planner 321 Ballpoint Pen 315 Envelope 315 Notebook 285 Top Tab File Folder 275.

You would then credit your. For sole proprietors and single-member LLCs show office supplies in the office supplies category of Schedule C on Line 18. AV Equipment Cabinet 1 AC Adapter 3 Academic Planner 19.

On the other hand Office Supplies are normally used for tracking Day-to-Day. Banking Money Handling Supplies 220 Coin Envelopes 182 Cash Boxes 97. Should I shop for school supplies online or in stores.

Any property that is convertible to cash that a business owns is considered an asset. OFFICE SUPPLIES SMALL EQUIPMENT Expense Account. Are Supplies Credit or Debit.

Chapter 9 2 Double Entry Accounting Accounting Debits Credits

Are Office Supplies A Current Asset Finance Strategists

Stationery Is An Asset Or An Expense Online Accounting

Office Expenses Vs Supplies What S The Difference Quill Com Blog

Office Supplies Are They An Asset Or An Expense The Blueprint

Are Supplies A Current Asset How To Classify Office Supplies On Financial Statements

/dotdash_Final_How_Current_and_Noncurrent_Assets_Differ_Oct_2020-01-e74218e547134e3db0ac9e9a7446d577.jpg)

Current Noncurrent Assets Differences Explained

Solved Current Assets Cash Accounts Receivable Less Chegg Com

0 comments

Post a Comment